888-227-8790

Profit & Growth

Insights

Thoughts, tips & strategies for entrepreneurial success &

wealth building

3 min read

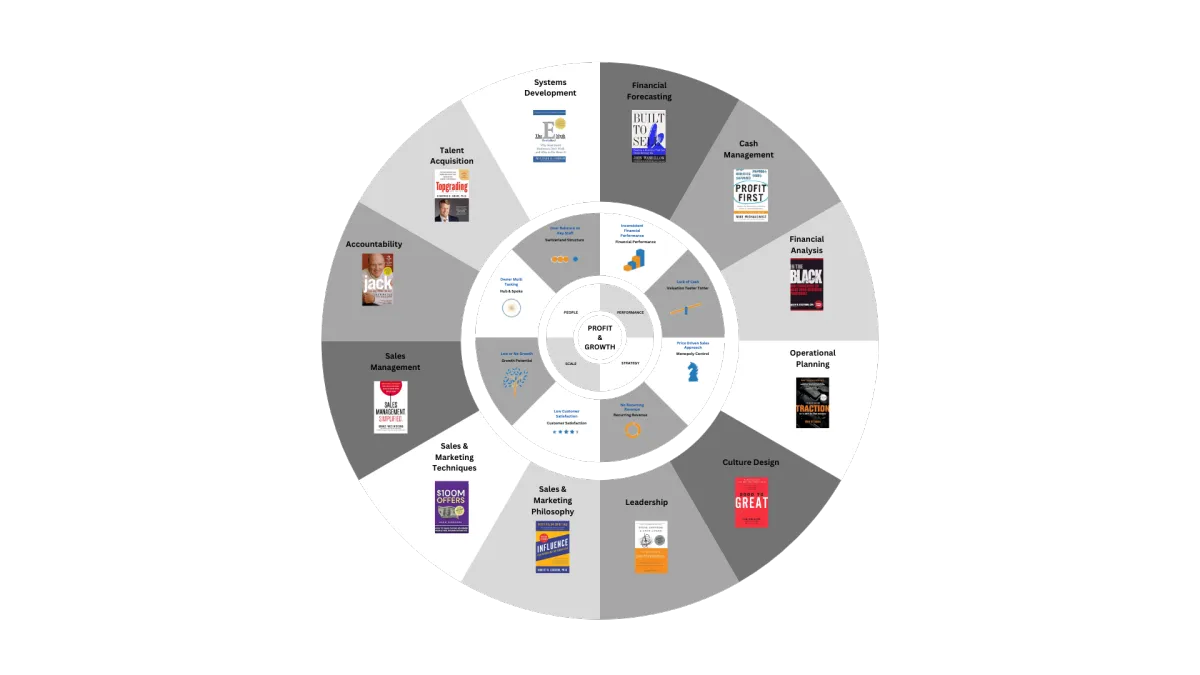

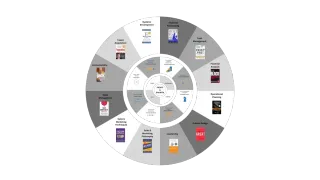

Unlocking Profit and Growth for Small Businesses: The Wheel of Success Series, Part I

Omari Kamal: Sep 5, 2024 2:34:35 PM

Introduction Welcome to the first in our Wheel of Success blog series! If you're serious about taking your small business to the next level, you're...

4 min read

From Cannabis to Community: How We’re Revitalizing Urban America with Purpose-Driven Investment

Omari Kamal: Aug 30, 2024 12:46:32 PM

Introduction In a world of booming industries and rapid change, it's easy to get caught up in the excitement of the next big thing. For me, that...

4 min read

How I Almost Went Bankrupt and Found My Miracle: My Journey with Profit First

Omari Kamal: Aug 23, 2024 1:34:51 PM

Introduction Let me take you back to July 2023, a time when I was on the brink of financial disaster. This is the story of how I nearly lost it all...

3 min read

The ITB Business Improvement Process: Your Roadmap to Profit and Growth

Omari Kamal: Aug 16, 2024 3:09:20 PM

Introduction No founder should embark on their business journey without a clear strategic, financial, and operational plan. Just as no airplane takes...

3 min read

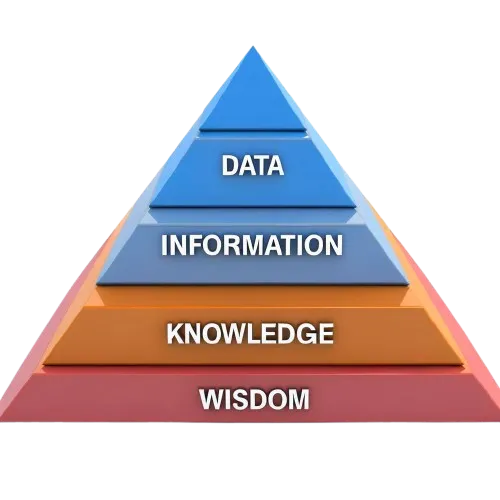

The Wisdom Pyramid

Omari Kamal: Aug 9, 2024 1:09:09 PM

The 9 Principles provide a framework for fulfilling any business goal and working through any business problem. Once again, however, there are no pat...

3 min read

9 Principles of a Profitable Business: Achieve Sustainable Success

Omari Kamal: Aug 2, 2024 10:24:25 AM

Introduction A principled approach is crucial for business success. As an investment advisor and business consultant, I've seen how following core...

4 min read

Unlocking the Secrets of Business Success: Understanding the E-Myth

Omari Kamal: Jul 26, 2024 10:18:00 AM

Introduction

3 min read

How Does P&G Work

Omari Kamal: Jul 19, 2024 3:30:00 PM

Hello.

3 min read

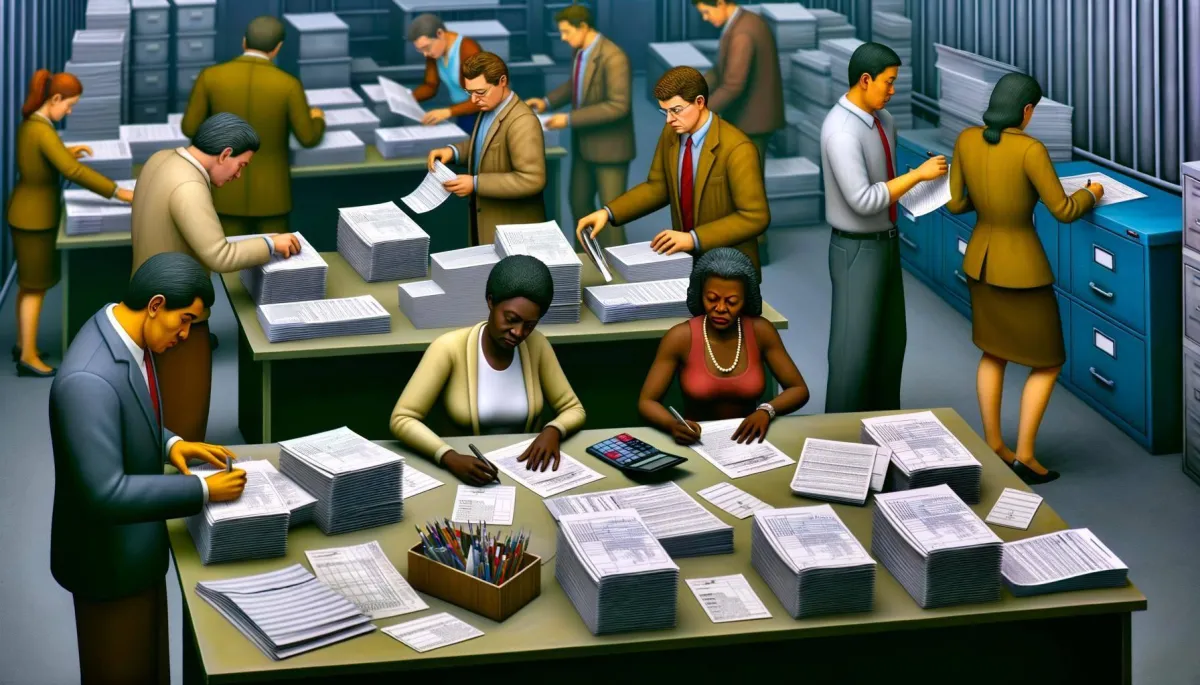

Tax Planning vs. Tax Preparation: What's the Difference?

Omari Kamal: Jul 12, 2024 10:00:00 AM

Introduction I often tell my clients, "Do you know the difference between 'tax planning' and 'tax preparation'?" Usually their response is, "No,...

3 min read

Building a Restaurant to Sell: Essential Strategies for Maximum Value

Omari Kamal: Jul 2, 2024 1:18:00 PM

Building a restaurant with the intention of selling it for maximum value requires strategic planning and meticulous execution. In this guide, we will explore key strategies to enhance your restaurant's appeal to potential buyers, covering essential...

5 min read

Profit First for Restauranteurs: Transforming Your Restaurant's Financial Health

Omari Kamal: Jun 28, 2024 1:27:54 PM

Running a successful restaurant requires more than just culinary expertise; it demands sound financial management. The Profit First system, developed...

3 min read

Unlocking Access to Capital for Small Business Growth

Omari Kamal: Jun 20, 2024 4:42:30 PM

Access to capital is crucial for small businesses looking to grow and expand their operations. Whether you're launching a new product, entering a new...

3 min read

Transforming Your Business: From Hustle to Well-Oiled Machine

Omari Kamal: Jun 20, 2024 4:19:53 PM

Are you truly running a business, or are you just hustling? Understanding the difference can determine whether your enterprise thrives or merely...

3 min read

Mastering Tax Planning and Preparation: Essential Strategies for Success

Omari Kamal: Jun 20, 2024 4:05:24 PM

Introduction: Tax planning and preparation are vital components of financial management for both individuals and businesses. Effective tax strategies...

2 min read

Mastering Financial Management: The Essentials of Accounting and Bookkeeping

Introduction: Effective financial management is the cornerstone of any successful business. At the heart of this discipline lie two critical...

Power Up Your Tax Readiness: A Comprehensive Guide to Tax Planning vs. Tax Preparation

Learn the key differences between tax planning and tax preparation. Discover actionable strategies to minimize tax liabilities and maximize business growth with expert insights. ...more

insights

October 18, 2024•6 min read

Unlock Financial Success with the Profit First Method: A Game-Changer for Small Business Owners

Discover how the Profit First method can transform your small business into a profitable, sustainable enterprise. Learn actionable strategies from Omari Kamal on driving profit growth and maximizing e... ...more

insights

October 14, 2024•5 min read

Master the Nine Principles to Unlock Financial Success for Your Small Business

Discover how the nine principles from In the Black by Allen Bostrom can help your small business achieve lasting profitability. Learn actionable strategies to improve sales, operations, and cash flow. ...more

insights

October 04, 2024•5 min read

The Path to Financial Freedom with T. Harv Eker’s Budgeting Model

Discover the budgeting principles from Secrets of the Millionaire Mind by T. Harv Eker. Learn how to achieve financial freedom through strategic money management and entrepreneurship. ...more

insights

September 30, 2024•5 min read

The Wheel of Business Success, Pt. III – Unlock Financial Success with In the Black by Allen Bostrom

Discover the nine principles from In the Black by Allen Bostrom and learn how to transform your small business into a profitable, sustainable enterprise. Start your journey to financial success today. ...more

insights

September 23, 2024•5 min read

Unlocking Profit and Growth for Small Businesses: The Wheel of Success Series, Part I

Introduction Welcome to the first in our Wheel of Success blog series! If you're serious about taking your small business to the next level, you're... ...more

insights

September 23, 2024•5 min read

Partner With Us Today!

Get the thoughts, tips and strategies for entrepreneurial success & wealth building

Download Our Free eBook, The 8 Key Drivers of Company Value

Legal Stuff | Privacy Policy

© 2024 P&G Advisors, LLC